Encouraging Thai customers & businesses to embrace digital payments in the long run

Over a year ago, UnionPay International released The Future of Payments Study which found that cash remains the most popular mode of payment. Now, however, in light of the recent developments with global pandemic, we see an accelerated shift from a cash-based to a cashless society as more people are adopting digital payments to minimise physical contact and cash handling. In order to support the Thai customers to fight against Covid-19 and to sustain the adoption of digital payments, UnionPay International is optimiziing its “contactless” payment services, including online and mobile payment services. We believe that through smooth payment services and attractive promotions, this is a good time for the public to better experience and understand the benefits of digital payments, beyond reducing physical contact.

The spread of this pandemic has dramatically changed our lifestyle, including how we pay. Recently, the World Health Organization (WHO)[1] suggested that banknotes may be one of the contaminating variables in the spread of COVID-19 as coronavirus can be contained on these surfaces for many days. As precaution heightens, various organisations have proactively encouraged the use of cashless payment. The Thai Bankers’ Association[2] urged general public to use e-payment channels to minimize the risk of any infection. Monetary Association of Singapore[3] also urged the use of digital payment to support safe distancing measures.

Similarly, UnionPay encourages customers in Thailand to adopt more contactless payment options such as online shopping when you are home, or contactless card payment and QR payment if you are out for essential matters like grocery shopping and packing food. In fact, there are multiple benefits of digital payments, beyond reducing physical contact.

In Thailand, UnionPay cards are not only accepted by 95% merchant locations, but also accepted by a number of popular online merchants, including the official websites of Wastons, Villa Market, Central Group, Decathlon, Supersport, H&M, Zara, and Power Buy. Customers can also pay with UnionPay cards for food delievery services via the apps like wongnai and Grab Food, or goods delivery service via the app of DHL.

- Fast and Convenient – Digital Payment unlocks our access to many goods and services in Thailand and around the world. We can enjoy shopping via various e-Commerce platforms. Not forgetting how we all can satisfy our cravings right at home with food delivery services.

In Thailand, UnionPay cards are not only accepted by 95% merchant locations, but also accepted by a number of popular online merchants, including the official websites of Wastons, Villa Market, Central Group, Decathlon, Supersport, H&M, Zara, and Power Buy. Customers can also pay with UnionPay cards for food delievery services via the apps like wongnai and Grab Food, or goods delivery service via the app of DHL.

- Safety and Security – Digital payments add a layer of security to ensure safe and secure transactions. Global payments company like UnionPay with vast network of users and merchants, need to ensure the security is top-notch. As such, great efforts are in place to ensure each payment transaction is secured. All transactions adhere to the system-safety management and data-safety management guidelines of local regulators, while security measures are continuously updated to meet the ever-changing global security landscape. This provides peace of mind for users when making any online transaction. In addition, the absence of physical contact with bank notes and coins eliminates the risk of surface spread of any viruses.

- Expense trackability and transparency – Digital payments also enable transparency. Each transaction made will have a digital footprint to allow easier expense tracking for both individuals and businesses. For instance, by going digital, businesses are able to keep track of each transaction made whether locally or cross border. By having that full view of expenses, business can then make informed decisions for their business strategies. All transactions can be pulled out in real-time via various banking applications, thus keeping all our spending controlled in our hands.

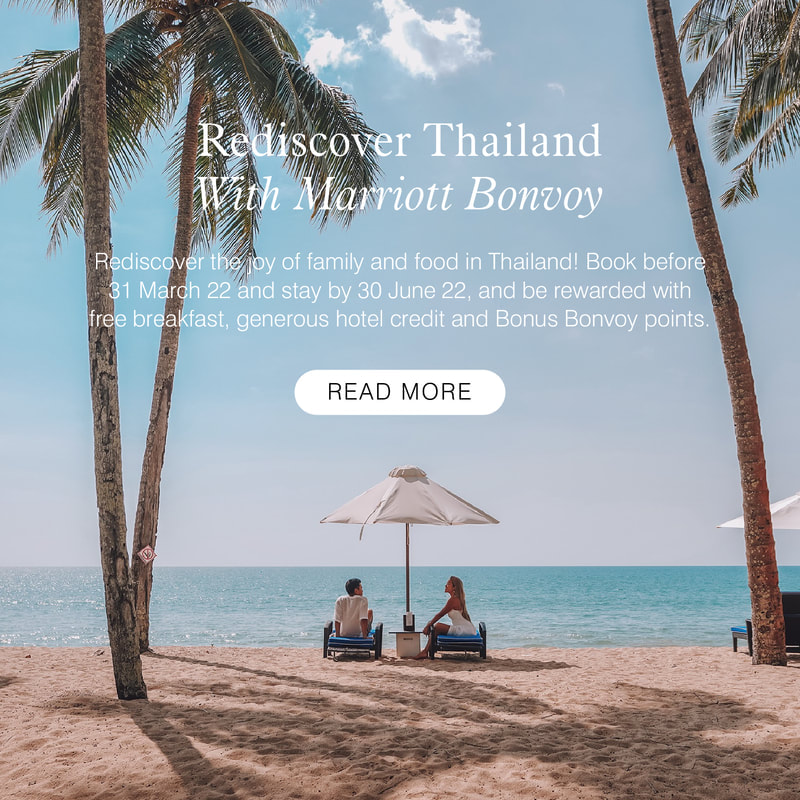

- Privileges and Promotions – Another great benefit of using digital payment is the privileges offered by UnionPay. Here are some exciting privileges for all UnionPay cardholders to encourage shopping online for the safety and convenience.

If you need to be at the supermarket to purchase grocery, UnionPay Contactless payment (via card, mobile phones or wearable devices) is accepted at popular pharmacy and supermerkets such as Boots, Gourmet Market, Lemon Farm Organic Family Food and more.

The current situation may be a factor in pushing more people to adopt digital payments, but it is UnionPay International’s commitment to help each individual and especially businesses to be aware of how digital payments can be beneficial to them in the long run, and be convinced on how to best integrate it into their daily lives or operations – it is certainly not as a short-term solution. If everyone starts embracing digital payments, no one will be left behind as Thailand stride towards a cashless nation in the near future. UnionPay International will make constant efforts to make the cashless society a plan in motion, rather than an ambition out of reach.

The current situation may be a factor in pushing more people to adopt digital payments, but it is UnionPay International’s commitment to help each individual and especially businesses to be aware of how digital payments can be beneficial to them in the long run, and be convinced on how to best integrate it into their daily lives or operations – it is certainly not as a short-term solution. If everyone starts embracing digital payments, no one will be left behind as Thailand stride towards a cashless nation in the near future. UnionPay International will make constant efforts to make the cashless society a plan in motion, rather than an ambition out of reach.

[1] Souces: https://www.telegraph.co.uk/news/2020/03/02/exclusive-dirty-banknotes-may-spreading-coronavirus-world-health/

[2] Sources: https://kasikornbank.com/en/News/Pages/TBA-COVID-19.aspx

[3] Sources: https://www.mas.gov.sg/news/media-releases/2020/mas-urges-use-of-digital-finance-and-e-payments-to-support-covid-19-safe-distancing-measures

[2] Sources: https://kasikornbank.com/en/News/Pages/TBA-COVID-19.aspx

[3] Sources: https://www.mas.gov.sg/news/media-releases/2020/mas-urges-use-of-digital-finance-and-e-payments-to-support-covid-19-safe-distancing-measures